Pre-Feasibility Study of a Commercial/ Residential Tower project proposed

for development on a 2,450m2 plot on Cornish road, Khubar City. The 8,760m2

leasable area costs SR 21.1 million to be developed, excluding

land value, and fully funded by the owner (Real Estate firm in Riyadh).

The study results showed unfavourable returns (IRR=3.7%) and the owner

was advised to reconsider the project operation and focus on unit sales

in favour of leasing which would yield 29.9% return on

total investment.

Concept Design and Area Program Definition for Marketing of a Residential

Tower project proposed for development on plot C2-1 in Dubai Sports City.

The project's 25,000m2 net leasable area comprises 320 residential units

of 4 prototypes spread over 16 floors in addition to 4 floors of open

plan

office spaces.

The study mainly focused on marketing tools rather than the feasibility

of

the project investment as per the Saudi real estate developer requirements.

Manama, Bahrain.

A concept design was proposed with Pre-Feasibility Study of the SR 682

million complex development that includes a 25-floors Five-Star Hotel

with 600 rooms, 30 Beach Chalets, Executive Apartments and Open Office

spaces for lease in designated floors of the main hotel tower, A Commercial

Complex (5,000m2 lease area), Movie Theatres Complex, complementing

the commercial complex housing 10 theatres, and Recreational and Sport

Beach Clubs including sea sports facilities for visitors all year round.

The pre-feasibility study results showed good investment returns for the

Saudi group of investors, with an IRR value of 24.6% and a 4.3 years pay

back period.

An Evaluation Study of different Roofing Systems for the development

of 61,000m2 warehouses on the Industrial Estate of a leading Saudi Group

of companies.

The study compared 4 types of roofing systems including a revolutionary

system by Walter Group and another system by Hexaport International, as

well as conventional steel frames and pre-cast structure.

A Value Engineering Study for a 38,000m2 Commercial Mall development in the city of Hael. The study managed to cut construction cost by 20% without major modification to the original design. The owner's target of 30-35% savings on cost were impossible to achieve without re-design.

The project structure proposal highlighted the company's scope of services which included housing, tourism, healthcare, and commercial projects, in addition to urban infrastructures and other metropolitan development schemes.Report also defined the operational roles, organization functional bases, and company's holding structure.

Best Use Assessment Study of an existing 6-stories building on Olya road,

Riyadh. The study proposed a renovation scheme of the building for the

utilization of its space in two alternative function scenarios: a Business

centre, or a Specialized Clinics centre.

Financial indicators of the study showed good returns on both investment

scenarios, giving the Saudi investor an Internal Rate of Return equivalent

to 21.9% from the business centre and an IRR of 18.6% from the second

scenario.

Best Land Use Study of a 73.5 million square meters raw land south of

King Fahad Airport. A schematic master plan was prepared and specifically

developed for; technical and light industrial projects, advanced technical

& academic research projects & exhibition centres that can be

sponsored by technical and industrial institutions, as well as housing

& commercial

projects that serves the community within the city.

The study highlighted the investment work plan stages and presented 3

development scenarios with economic indicators of the returns on

investment.

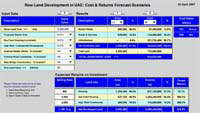

Cost & Returns Forecasting Computer Model developed for a Leading Real Estate Developer in KSA.

The model assists the investor/user in making informed decision instantaneously by changing few input parameters related to development zones of the 3.4 million square meter site offered by the owner for sale and development in Sharja.

A pre-feasibility study for developing a 200 room's 5star hotel with

a complex of recreational facilities oriented for families, on a 50,000m2

site at Jumeirah's Palm Island owned by a Saudi Investor.

The study showed very good internal rate of return IRR=22.1%, and a 5.8

years pay back period for the required development budget of SR 125 million.

Feasibility Study for a complex project development on a 7,500m2 plot

in

the central district, with a view to the Prophet Holly Mosque. The project

comprises a 400-rooms 5-star Hotel, 50-Beds Hospital with 25 Specialized

Clinics, and 5,000m2 Retail Outlets for lease.

The market demand results shown in the study convinced the Executive Committee

for the Central District Development in Madinah to reduce its leasing

demand terms on the Saudi Investor from 200 Beds to 50 Beds' Hospital

development. The SR 130 million project investment will yield

an IRR of 10.9% with 8.1 years pay back.

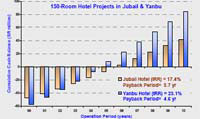

A Pre-Feasibility Study for the development of two 4-star hotels in the

cities of Jubail and Yabu on sites owned by a local Saudi Real Estate

Developer.

The base program for Yanbu project was adapted from an existing design

on a residential/ commercial complex, while Jubail’s development

program was yet to be designed. SWOT analysis of operational returns was

studied and results showed better returns for Yanbu project.

A Pre-Feasibility Study for developing a 22-story tower on an 807m2 plot

in Ajyad district near the Holly Mosque, Makkah. Three alternative developments

were considered; 3-star & 4-star hotels, and a combined hotel/ freehold

apartments tower.

All 3 alternatives gave poor return on investment ranging from 4% to 8%

due to the high land value. The third scenario would yield 15.9% return

on investment if designated apartments in the tower are sold.

Technical Urban Planning Study prepared for a Saudi Landlord to build

up a case for presentation to the Riyadh Municipality for granting excess

building heights on certain plots of his 1.79 million square meter blocks

of land,

north of Riyadh.

The study built up a case on the bases of analyzing five factors including

the effects of Riyadh's strategic master plan, height regulation on commercial

roads, development of King Abdullah road, other pilot studies conducted

and implemented in Jeddah, and field survey of neighboring districts.

Best Land Use study of a 10,680m2 plot of land on the Northern Ring road,

owned by a Saudi Group. Thestudy scope included 3 alternative commercial

developments based on the outcome of field survey and market demand.

1- Commercial Centre, 2- Department Store, and 3- Car Showrooms Centre.

The study compared the development costs and expected returns and advised

the owner to opt for the second development scenario, despite

having less returns than the first, on the bases of less risk factors

involved.

Marketing Research commissioned by a Real Estate Developer in the Eastern

Province to support his campaign for launching a mega development project

of reclaimed land on the shores of Khubar. The scope of work covered desk

research and field survey.

The research findings analyzed the real estate market demand indicators

and risk factors in addition to producing land prices Atlas Maps of Dammam-Khubar

area.

Feasibility Assessment Study of redeveloping a 21,500m2 recreational

centre on Cornish road, Jeddah. A 240-room Hotel, 100 showroom outlets

centre and indoor amusement facilities were proposed for development

with a development budget of SR 67.5 million.

The Financial indicators conducted for this study showed good internal

rate

of return on investment (IRR=19.3%) and 6 years payback period.

Best Land Use Study of a 7,500m2 plot on Cornish road, Jeddah. A Food

Court Centre was the best choice for development on this site, offering

the Saudi investor low initial capital investment (SR 9.6 million), low

risk and high returns.

The pre-feasibility assessment for this development gave an IRR of 16.8% and 3 years payback period.

Feasibility Assessment Study of beach front land subdivision and evelopment acquired by a well known Saudi Real Estate developer in the Easter Province.

Three scenarios were proposed for development on the 200,000m2 site.

Development costs and expected plot sales returns were investigated.

The study outcome assisted the investor in pursuing joint venture schemes

with potential individual investors.

Economic Indicators Study for an 8,760m2 investment site at Al-Nafle

district, north of Riyadh city. The study commissioned by a distinguished

real estate development company in Riyadh, covered the RE market review

in general and identified the housing sector demand in the Riyadh region.

The study proposed the development of 28 housing units of 3 prototypes

oriented for small family size buyers. The project's feasibility assessment

indicated 20.2% returns.

Feasibility Study Computer Model developed for a Leading Real Estate

Developer in KSA to instantaneously re-evaluate the feasibility of a SR

1.86 billion complex project development on a 64,200m2 site in Ajyad,

Makkah.

The user friendly designed, excel based software allows the user to modify

input parameters for the five main building components

comprising the project.

The model assists the investor/user in making informed decision instantaneously

in response to changing requirements of the Central Committee for Makkah

Development, without the need to re-commission new feasibility study when

changes of the project components occur.

The Model was later upgraded to include selling analysis module for partial

sale of project components or for the whole project.